(generated by Midjourney)

As an early-stage investor, I spend a lot of time looking at all things machine learning, AI, and data infrastructure. One of the projects that I recently worked on was Firstmark Capital’s annual MAD Landscape. In analyzing over 3,000 companies (that have raised an aggregate of $153B in funding across different rounds!), one of the trends that stood out was the scale and investment direction of venture capital in China. This is especially interesting as the western world and China go through a period of “conscious uncoupling” (Gwyneth please don’t sue me) in their technology development, especially within the realm of AI.

Part 1 of this post explores some of the macro funding trends in China, the funders who back AI/ML/data startups, and how China and the United States have broadly chosen to allocate capital in very different ways. Zooming out, Part 2 (coming in a week or two) highlights the importance of semiconductor sovereignty in the progress of AI research, product development, and investing. I also look at some of the broader, second-order effects as a result of our current semiconductor tensions. Let’s dive in.

In the world of MAD, it’s US, China, then everyone else

For the rest of this blog post, MAD companies broadly encapsulates companies in the various MAD categories/sub-categories (Infrastructure, ML & AI, Analytics, Applications, etc.) that received funding between August 2021 and December 2022. For detailed methodology, please refer to the “Methodology” section of the post at the end.

Starting with the headline numbers, the United States leads all countries in dollars deployed across the MAD Index at $34.89B, with China coming in at a distant second at $8.39B.

At first glance — it would seem that China is far behind on ML/AI investments. The reality is much more nuanced, however. First off, the incremental venture dollar invested in China likely goes a lot further due to the significantly lower cost of labor. Using software engineer salaries as a rough proxy, the median Chinese software engineer makes just $71K, while the median US software engineer makes $170K (according to Levels FYI at the time of writing).

Additionally, across the entire venture landscape, funding in the US only fell ~30% in 2022 (from $345B in 2021 vs. $238B in 2022), whereas funding in China fell ~42% in 2022 for the first 11 months of year (vs. ~$114B in 2021), driven in part by prolonged covid lockdowns. Diving a bit deeper — the decline of US dollars flowing into the Chinese AI ecosystem is partially to blame. According to a similar study conducted by Georgetown University, American VCs deployed an aggregate of $40.2B into Chinese AI startups over a 6 year period from 2015-2021, accounting for 37% of total dollars invested in AI in China. This implies $108B was invested these 6 years, or $18B per year. Here, Georgetown likely has a more relaxed definition of what an AI startup is (compared to the MAD Index). Georgetown’s study does, however, give an indication that overall AI funding in China has dropped precipitously in recent years but was quite competitive with the US before.

I’m very interested to see how funding in China looks like going into the rest of this year, where there are multiple multiple forces at play, including:

US regulations increasingly limiting American investments in certain high-tech sectors

Fears that Chinese capital controls will be even more stringent going forward

A reopening China that will undoubtedly be very focused on LLM products after the success after ChatGPT (and the announcement of GPT-4, Anthropic’s Claude, and Google’s PaLM APIs all on the same day!)

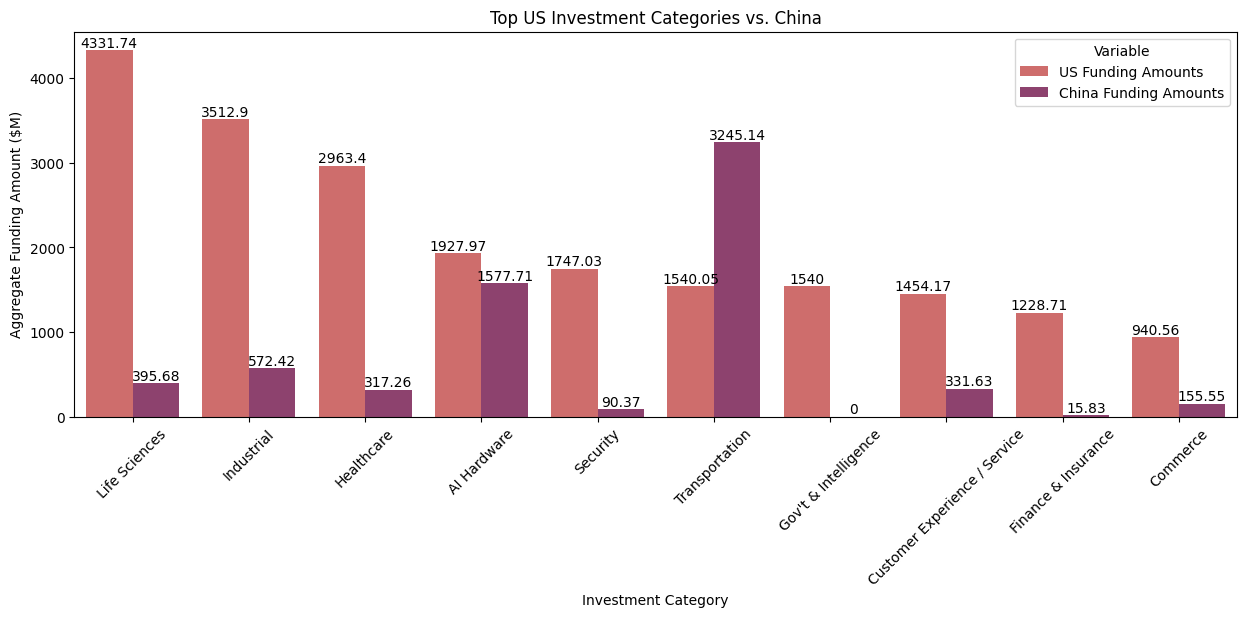

Up next, we break down investments by category, and things become more interesting. If we look at the top 10 US categories by dollars invested, and contrasted against China, we have the following:

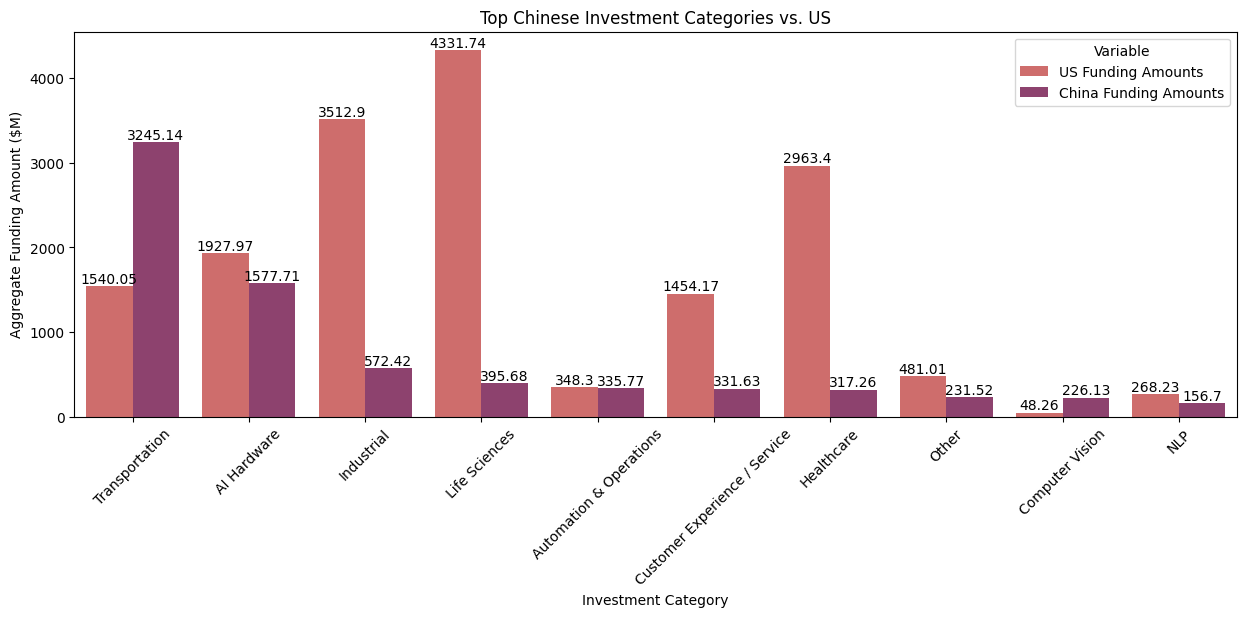

Here, we see that for the top 10 US investment categories by dollar amounts, the US leads by a wide margin – except for Transportation (generally autonomous driving companies). Flipping things around, we do the same for China

Here, we see that Chinese investment “spikes” in Transportation and AI hardware (where >50% of all Chinese venture dollars are allocated). Given Biden’s recent restrictions, China is likely looking to cultivate its own national champions and develop a parallel/independent autonomous driving and AI hardware stack. What’s also notable is that the remaining categories tend to focus on the deeper tech (industrial, life sciences, computer vision, NLP) or the core “utility” (Automation & Operation, Customer Experience / Service) side of things, while the US can afford to allocate heavy investment dollars into categories like Commerce and Finance & Insurance in addition to “core” categories.

Next up, I wanted to understand the VCs who compete in the Chinese AI/ML ecosystem, as China has some massive funds like the Yale-influenced Hillhouse Capital, which are for the most part overlooked in the West. The top VCs (across all stages) by deal count are:

Hillhouse Capital Management: 6

GSR Ventures: 6

GGV Capital: 6

Tencent Holdings: 6

Innoangel Fund: 5

Sequoia Capital China: 5

Tencent Cloud: 5

Yunqi Partners: 4

IDG Capital: 4

ZhenFund: 4

FH Capital: 3

China Internet Investment Fund: 3

Chengwei Capital: 3

Tisiwi Ventures: 3

5Y Capital: 3

Going forward, I wonder how western VCs with China-specific funds will choose to underwrite investments when there is significant geopolitical risk, especially if such risk can result in total portfolio wipe-outs.

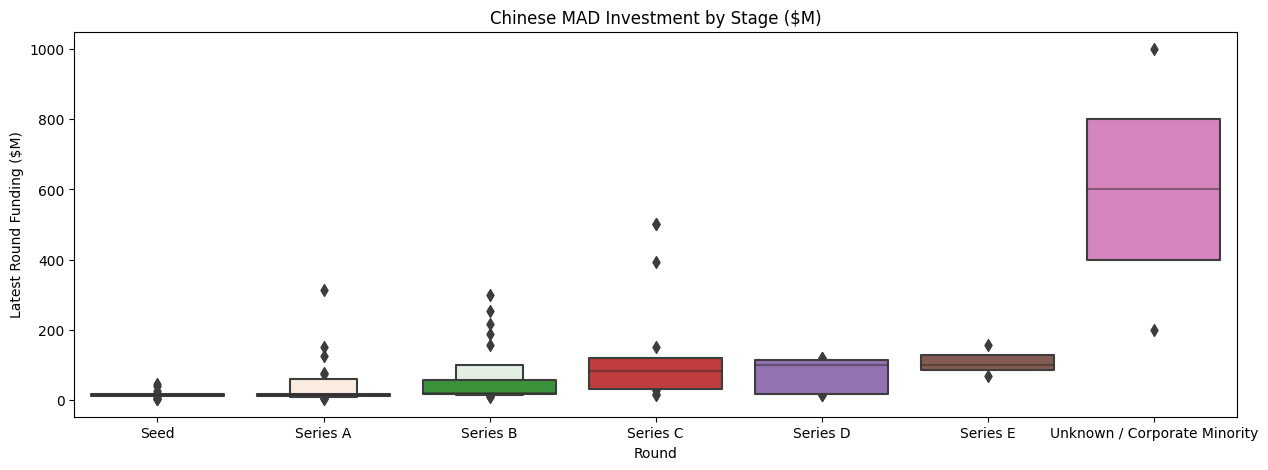

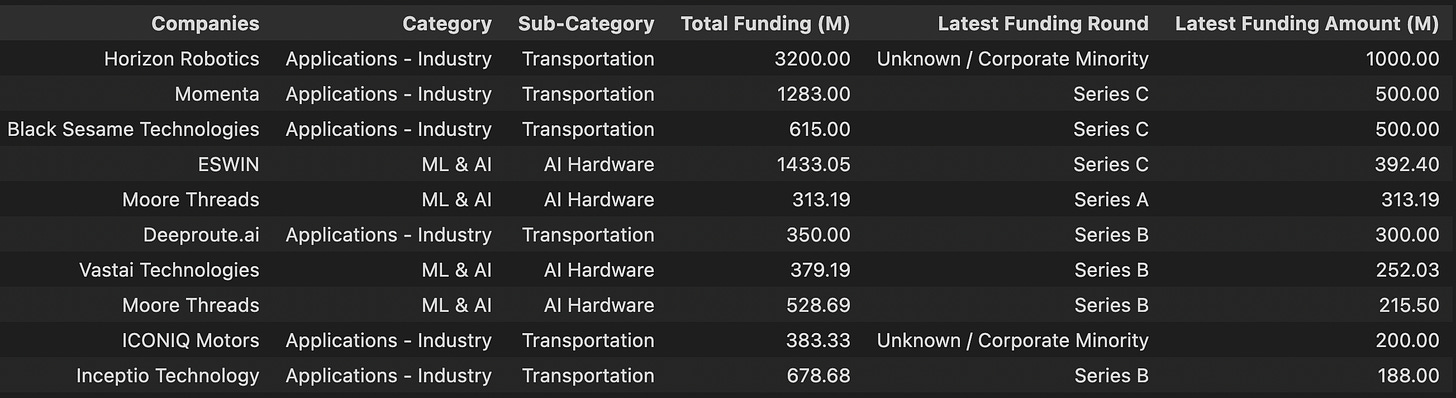

Just for fun, I looked at funding by stage, and noticed a number of outlier financings, of which the top-10 in aggregate amounted to ~46% of all VC funding in China during our period of analysis! (Note that Moore Threads raised two rounds of financing during in this period).

Looking at the same box-and-whiskers plot of the US doesn’t give us a ton more extra information.

The one outlier that really stands out here is Anduril’s Series E funding, which was at a massive $1.48B! The other statistic of note is that the top 10 financings in the US only account for ~14% of total financings — indicating that financings are much more distributed among startups. As an example, US VC's could afford to pour heavy dollars into multiple life science or AI hardware companies, whereas China seems to have picked one or two winners for each part of the “stack”.

As I think about these two parallel tracks of funding, the key takeaways are that:

The US VC ecosystem has generally taken the laissez-faire, “letting a thousand flowers bloom” (thanks Matt / Mao) approach to investing. This has traditionally worked because the amount of LP dollars that flow into the American ecosystem dwarfs every other nation in the world

China, on the other hand, seems to have some invisible hand that has directed investment dollars into the more “deep tech” parts of the tech ecosystem (and concentrated in fewer companies)–perhaps with the understanding that having these technologies available onshore will be accretive in future (potential) great power conflicts

As we seemingly enter a period of capital scarcity, venture firms in the US have to be much more deliberate in how they allocate their dry powder to drive returns (especially as we see overinvestment in many of the “low-hanging” MAD categories). This could mean taking on more technology risk or betting on new business models. The meta question is then – will capital be concentrated in a select few investment categories (given how many Web3 VCs are seemingly now gen AI experts, that seems to be the case), and if so, does that present openings in investment categories with relatively saner competitive dynamics for investors willing to look harder?

And that’s a wrap! I’ll be back soon with Part 2 of this post on the current state of semiconductors (something that my coworkers know I won’t shut up about).

Methodology

In aggregate, I analyzed a total of 3,159 fundings and M&A transactions that fall under the general bucket of AI/ML companies, of which 2,421 were applicable to the MAD Index (there are companies that claim to be MAD companies, but did not have significant elements of AI/ML embedded in their products).

As a result, the deal volume & values will generally be a “floor” of total counts from the raw underlying data

The period of study was over seventeen months – essentially fundings after our MAD 2021 and ending in December 2022. Going forward, I may choose to make this an annual thing

Similar to the main MAD landscape, some companies straddle multiple categories, so an editorial mindset is applied here as well

In terms of the categories themselves, I used a blended version of the 2023 and 2021 MAD categories with some slight variations – for example, a cybersecurity company would fall under “Applications - Industry: Security” while a clean data room company would fall under “Infrastructure - Privacy & Security”. See the 2023 categories here, and the 2021 version here

I noticed some potential data quality issues from the underlying dataset. As an example, Notion’s $275M financing is listed as “Seed VC - II” in my dataset (which I compacted to “Seed”), but “Series C” in some other datasets. In these cases, I deferred to my dataset’s nomenclature, but double checked that the round sizes were correct

Big thanks to Will Lee & Will Bitsky for the review! As always, if you’re a founder working on anything ML/AI/infrastructure related, please don’t hesitate to get in touch! I’m around on Twitter or LinkedIn!

Why is China so dependent on US funding for its AI startups? China has a capital account surplus, so it should have no shortage of capital to invest in such startups.