One of the recent “shower thoughts” I had was around how macro trends in venture capital, coupled with the avalanche of new AI research announcements, will profoundly change the broader venture and startup ecosystem. What I kept on coming back to was Howard Marks’ Sea Change memo, where he highlighted the three major sea changes during his decades as an investment professional. I can’t help but feel that this time things really are different, and that we are sailing into uncharted waters.

This post will be broken down into two sections. The first section will highlight some of the trends happening across the venture ecosystem, which include:

The curse of scale on venture capital, and lower returns going forward

Data science & AI making a resurgence of sorts in the VC investment process, but in potentially interesting ways

VC becoming “higher frequency” despite being generally a low frequency game

The second section, meanwhile, will be a series of predictions of where I see VC potentially going

How Solo GPs and smaller/nimbler firms could harness AI to rival much larger investment platforms

VCs becoming more like a “traditional” asset class (but with a bit of a twist)

How “calm funds” might make a comeback in a world of capital-efficient, AI-native startups

Heightened CVC/cloud hyperscaler activity, and why massive funding rounds in foundation model companies probably won't continue

Let’s dive in!

Surfing the tidal waves

The curse of scale in venture capital, and why we’ll see lower returns going forward

One of the things that’s been frequently discussed has been that the VC industry as a whole “over-raised” on the promise of high returns (especially when funds were smaller & there were a smaller number of funds), leading to a situation now where a large number of funds are:

Competing for a limited number of deals that can actually be considered “fund returners”

… in a high interest environment where revenue multiples for both public and private companies were crushed in 2022 (though we’re seeing a bounce back in 2023), leading to lower outcomes

… even as VCs, with larger pools of capital, pay up for deals resulting in lower ownership

As a result, there has been both a decline in DPI (distributions to paid in capital, which is the dollars actually paid back to limited partners) as well as TVPI (total value to paid in capital, which includes DPI, as well as gains that have yet to be realized). Looking at a chart that the dictator himself/All In Podcast bestie Chamath and Brad Gerstner of Altimeter exhibited, we see that even top quartile funds barely break 2X on a DPI basis (dollars actually returned to LPs)!

Source: Cambridge Associates

Just for fun, I ran my own analysis using PitchBook’s Q3 Venture Monitor data (PDF and Excel can be found here). I mapped cashflows into VC funds against net distributions back to LPs (serving as a proxy for DPI). This is a more intellectually honest way than simply using deal values (which would include non-traditional investors like family offices) vs. exit values (which only reflects the IPO/M&A price, not VC ownership in those companies).

I used the following methodology and assumptions:

I assume that dollar contributions via capital calls get deployed into companies that same year, though in practice things might be more “dragged” on.

I map the returns of a given vintage year against dollar distribution 7 years later (the returns from 2006 would map to returns in 2013).

To “smooth” returns, I use a sliding 3 year window (so the returns for 2006 would be the weighted average returns of 2012, 2013, and 2014). The weighting for 2012-2014 would be 25%, 50%, 25% respectively. Here, I adopt the following reasoning:

Theoretically, in a 10 year fund, one would make investments from year 1-3, then harvest from years 8-10 (though in practice, funds tend to last longer— see the SVB chart a few paragraphs below)

Meanwhile, growth funds have much shorter time to liquidity, and are able to put more dollars to work, this would “pull” the distributions forward

I used 7 years as a mechanism to balance these two factors.

The graph here reflects a similar trend to the analysis that Cambridge Associates ran — that actual, realized returns are much lower than the coveted 3X that VC funds typically aim for (mean is 1.99, median is 1.81).

But wait! This doesn’t actually seem THAT bad, VCs as a whole in 2013/2014 seem to have achieved ~3x despite poor performance in other years. What seems to be happening? Upon further analysis, these “DPI” numbers are inflated:

Although we are showing real cash flows in to VC funds & distributed back to LPs, these numbers are the theoretical max, given there is a fair amount of residual value from years prior to 2006. To see why, take a look at the median TVPI/DPI chart from SVB below. Here, we see vintages from 2008-2010 still carry quite a bit of residual value even in 2023 (nearly half of the theoretical max DPI in the case of 2009). This would mean that a good chunk of cashflows from 2013-2020 distributions would be from 2000-2005, which would drag our calculated DPI down quite a bit if adjusted for. As an example, Stripe was founded in 2010, but is still waiting to go public given the dynamics in the public markets.

Correspondingly, the returns from 2013 and 2014, where we are seeing 3.2x and 2.9x DPI, respectively, would actually be partially attributable to some of the returns in 2009-2012

Which means that the “true” mean/median values would actually be lower (when I apply a 20% “discount” to the distribution cashflows above, mean and median fall to 1.59x and 1.45x, respectively). More importantly, the “max” DPI years might actually be in the low/mid 2’s given how things are spread out

Source: SVB

A few conclusions to draw from this:

The “DPI” exercise I performed is an average of all funds in the US, with a distribution/contribution ratio below 2x in my period of analysis. However, given that median funds barely break 1x DPI, and top quartile funds are barely breaking 2x DPI, I think it truly is the top decile funds that are “yanking” the average distributions up.

VC funds, even though they are supposed to last ~10 years, see quite a bit of residual returns in the “out years” (after year 10), therefore IRR figures would be quite a bit lower despite capital call dynamics (capital is generally called as needed to juice IRR)

Even assuming a ~3x fund, over a 7 year period that is only ~17% IRR, which is quite a bit below the 20% returns that the VC asset class is supposed to provide. At a sub 2x DPI, which is the value we calculated, IRR actually drops to well below 10% (so an investor ends up being better off just compounding off of public market beta).

Ok, let’s see what this actually means for a fund manager. A $500M Series A fund trying to generate 3X returns for LPs might look a bit like this:

$400M of the capital would be actual “investable” capital, while the other 20% go into fees over a 10 year fund lifecycle (assuming no recycling and that fees don’t “roll off” in the later years).

Assuming a 1:1 ratio of initial investment dollars to reserves, ~$200M of that capital might be used to make initial investments, while the other ~$200M would be used as reserves to double/triple down on fund breakouts

Let’s assume that this hypothetical fund only leads investments, with median deal size of $10M at a $40M pre-money valuation (according to this Crunchbase article, median Series A deal values are actually higher, at $12M), and that the fund cuts $7M checks.

This means that the fund will own, on average, 14% of a startup at the time of initial investment

Therefore, that fund would be able to invest in ~30 companies with its first $210M, and use about half ($190M) of its capital to defend its ownership at later stages (in actuality the number of investments would be higher because that Series A fund would write smaller checks at the seed stage).

Now, going back to returns to LPs, that initial $400M of investable capital must somehow return $1.75B in gross proceeds to get $1.5B in net proceeds to LPs (the $250M would be paid out as carry to the GPs for the $1.25B gain on the fund), so we’d need ~4.4x returns on the $400M! Put it in simpler terms, assuming the fund owns ~10% of each company at exit (so the initial ~14% we had above gets diluted, even with fund reserves), we’d need $17.5B in exit value to return $1.75B to the fund! As we saw above, real DPI is much lower than this figure. (In practice, many funds do recycling management fees so you don’t need as high of a multiple).

Source: Battery Ventures

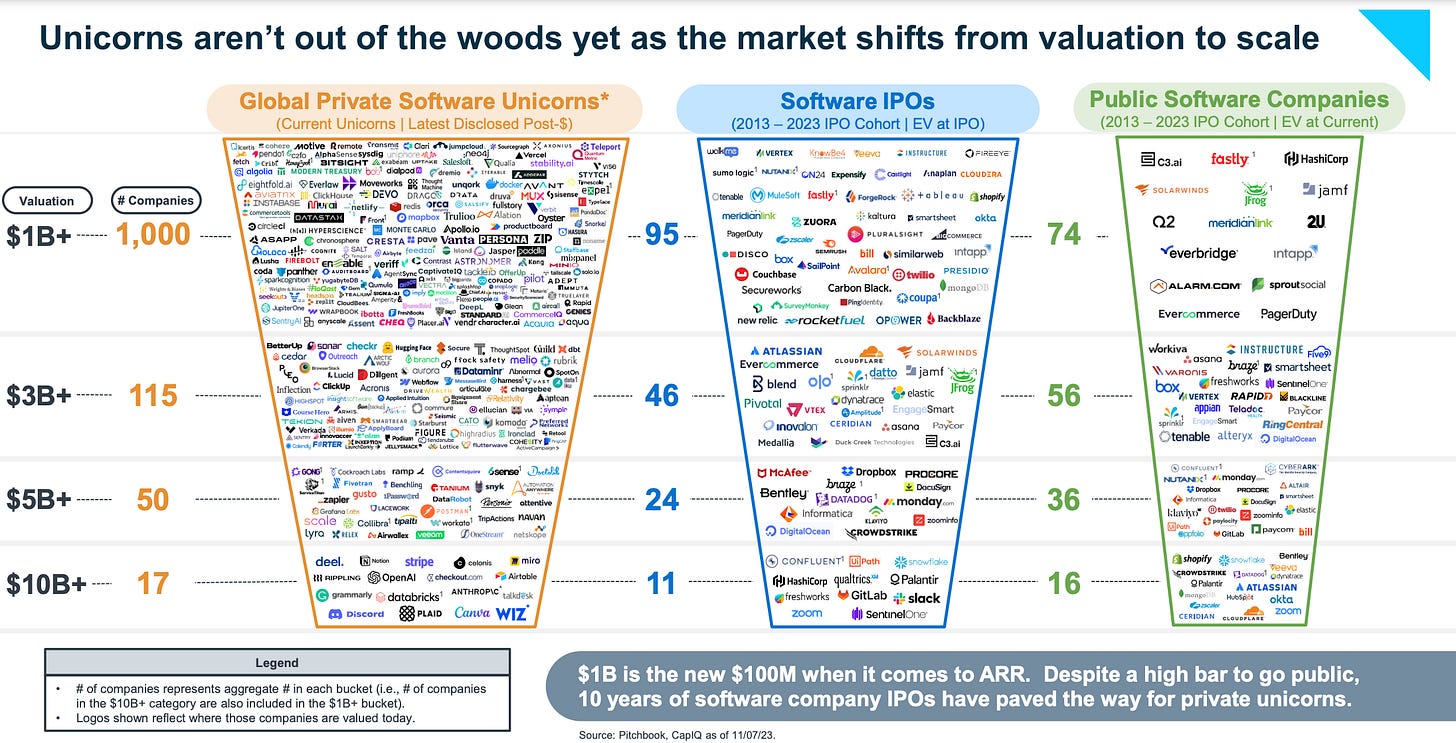

The double whammy in portfolio math is that in the public markets, there are only 74 public software companies valued at $1B+ according to Battery Ventures. Going back to our fund, we’d need 10 of these to result in a 3X DPI, which is mathematically hard (you’d need to capture 13.5% all public software companies in a 10 year cohort, assuming an average $1.75B exit value). Now, there are acquisitions as well, but as we see below — the banner years for returns (2020/2021) saw most of the actual exit value be captured by public listings, and large acquisitions of companies at high ARR multiples (like those of MosaicML and Figma) are typically for strategic reasons (and therefore are one-offs).

Source: PitchBook Venture Monitor Q3 2023

To drive this point home, I really like Hunter Walk’s framework of “who gets to eat” in VC (seed funds/A funds with high ownership get to eat at the $1B exit level, whereas you’d need $10B exits for everyone on the cap table to eat). Relevant posts here and here.

So maybe the conclusion to draw from this exercise is that despite hyped VC rounds and TechCrunch announcements, all startups must eventually submit to the gravity of the public markets. That being said, if we start seeing rate cuts in 2024, there will likely be a new cycle where we see companies start being priced at >15x NTM revenue multiples.

The rise, fall, and rebirth of data science

The above analysis emphasizes how crucial it is for funds to gain some edge in sourcing, evaluating, and winning deals. One of the ways that funds have begun to differentiate themselves in recent years is the use of data science in the sourcing/evaluating steps of the investment process. The use of data science to analyze different signals has been around for a while now (I had written about this back in 2021 as well). The idea was that funds with some amount of technical sophistication could theoretically, using differentiated data and analysis, leverage in-house data science to surface interesting companies in the order of weeks/months ahead of multi-stage investors, and therefore can avoid a price war.

Early iterations of this included things like tracking GitHub star growth, number of collaborators, number of issues within a given open-source repository. Over time, however, these signals became “gamed” (as seen via this article from Dagster). In fact, a recent Wired article featured several investors (including yours truly) on how VCs used data science signals in their investment processes.

I don’t think the use of data science (and now AI) is dead by any means, and see several interesting directions that more tech-savvy funds can go, both during the sourcing and diligence stages of the investment process:

In sourcing: funds can do things like analyzing Slack/Discord conversations to see things like the level of community engagement within a given open-source project (ratio of founder Slack messages to community messages, clustering the topics of a Slack channel, etc.). One of the things I did when I joined one of these open-source Slack channels was to see who were the investors in the channel (so I could get an idea of the relative “heat” of a deal). Another interesting direction is using large language models to analyze Hacker News product launches, at scale.

In diligence: This is where I think things get very fun. I believe, relatively soon, AI models will be able to abstract away a lot of the manual “data crunching” (cohort analysis, revenue projections, etc.). This frees investors to focus on the “magic” parts of a deal. AI will also speed up research in novel domains. A couple ideas there would be VCs using specialized versions of large language models (or just vanilla ChatGPT) to do Q&A as the first steps of market/technical research, or integrating these language models into platforms like Tegus to speed up the analysis of expert calls)

Regardless of how VC funds use data science, I think the use of DS and AI will be critical for funds to see deals earlier.

VC becoming “higher frequency”

The primary effect of more dollars in the VC industry has been the steady intensification of competition. One of the ways that VCs competed (beyond brand pedigree, platform support, not taking board seats, etc.) is to simply move faster.

Now, there are a few ways to “move faster”:

Investing in entrepreneurs even earlier. Funds are approaching talent even before they leave their current jobs (e.g. reaching out to OpenAI/Deep Mind engineers/researchers as they hit their 4 year vest). Just as an anecdotal example, when I attended NeurIPs in 2019 as an engineer at Salesforce Research, there were just a handful of VCs in attendance (and meeting PhD candidates at poster presentations was a valid way to generate alpha), fast forward to now, investors are flocking to conferences like NeurIPS, ICML, and KubeCon, so there is an expectation that everybody will meet everybody.

Multi-stage/later stage funds moving upstream (funds like Greylock, Bain, and Sequoia have launched programs to work with entrepreneurs at startup formation)

Funds speeding up the diligence process (this was especially prominent during 2021) so they can offer term sheets before rival VCs. This is where AI can play a huge part in giving a tech-savvy fund more of an edge vs. more traditional shops.

I’ve been thinking about this “frequency” phenomenon in the context of high-frequency trading, where funds that can get to a trade first would squeeze out other funds trying to make the same trade. In venture, the dynamic is similar in that there tends to be a single lead investor that actually gets the ownership it wants, at the expense of other funds. The main thing that’s different though, is that just because a fund bids on a deal faster, doesn’t mean it’ll win the deal. The meta question for me is: as sophisticated deal-surfacing strategies become common place, how can funds then increase their probability of winning their desired deals? This is probably something that VCs will continue to think about, lest they become thin wrappers over commoditized capital.

Playing the Oracle

Given these “tidal waves” sweeping over the VC industry, I see some interesting directions that the industry as a whole could go.

Solo GPs powered by AI, and a general contraction in the VC market

In the past few years, there has been a rise in the number of solo GPs as LPs looked to gain exposure to the venture asset class. While LPs are currently retrenching to a much smaller number of funds given macro conditions, I do see solo GP funds that survive be extremely effective. Using AI for sourcing, diligence, and back-office, these funds can match the capabilities of much larger rivals, while being able to move much faster on deals vs. needing to reach consensus within a given partnership. More broadly, I anticipate that there will be a “fading out” of some existing funds, as well as a contraction in the number of seats available within a fund as firms get more efficient.

The resurgence of “calm funds”

Given the leverage that AI provides small, lean, and most importantly, profitable teams, I see a potential rise/return of calm funds, where these funds invest in companies that don’t necessarily need to generate explosive exit values, but are profitable relatively early in their company lifecycle.

In the case of calm funds, they would target companies that generate attractive cashflows/reasonable (but non-venture) growth type companies. Now, where AI plays into this is that traditionally, niche software was still complex to build, but had limited market size, so it was not economical to fund large teams addressing comparatively smaller markets. Assuming the leverage that AI gives to software development teams continues to increase, we’ll see these more niche ideas becoming economical, and the calm funds by which to fund them correspondingly becomes viable as well.

VCs turning into a more “traditional” asset class, with a twist

Some VC funds have already started to morph into traditional PE-like funds (e.g. Blackstone, KKR, etc). Currently, large VC platforms already operate in somewhat of a similar manner, where different partners might invest out of different funds (SaaS vs. biotech, or early-stage vs. growth) but still largely operate under the same banner.

Now, if we stretch this thought further, what if more venture funds wade into public markets? This is admittedly a much more speculative prediction, but taken to its logical conclusion this would mean GPs become PMs (portfolio managers) in a traditional hedge fund sense (think PMs at Citadel, Millenium and Balyasyny). Obviously, where this comparison breaks is that it’s difficult to gauge GP performance until the back half a given fund/strategy (vs. PMs who are marked to market daily).

In this future, I could see LPs having much more fine grained control over how they allocate to a specific venture firm, for example allocating a certain percentage to early stage fintech vs. some other percentage for growth stage software infrastructure based on some risk model (this is different from hedge funds where PMs get allocated dollars at the firm level, not at the LP level). An extension of this thought experiment is what happens if LP stakes become tradable?

CVCs (corporate VCs) and cloud hyperscalers stepping into the arena, but only temporarily

I won’t dive too deeply into this (as this probably warrants its own long form article), but what’s been a trend in the past couple years has been the willingness of CVCs and the parent organizations of cloud hyperscalers (and hardware designers like Nvidia) to write extremely large checks into AI startups. The two most prominent examples here are that of Microsoft investing $10B into OpenAI, and both Amazon and Google putting billions of dollars into rival Anthropic. Salesforce Ventures has also been active, having made investments into multiple foundation model providers (Anthropic and Cohere).

What’s been interesting here has been the deal structure (whether it is in the form of cloud credits in the case of Anthropic or debt collateralized by GPUs in the case of CoreWeave). I don’t actually anticipate this being a sustained trend (assuming hardware continues to get better and we introduce new, compute efficient AI architectures).

Where do things go from here?

As hopefully is evident by now, venture is indeed in a funky place. For larger funds, I can see them continuing being asset aggregators, which may be, in the words of Marvel supervillain Thanos, “inevitable”. And that is fine! They are fundamentally selling a different financial product to a different customer (and that customer might be ok with lower returns because they a) want exposure to venture b) need to invest in funds that actually have the capacity to absorb large amounts of capital).

Where I think things get interesting are funds that remain disciplined in staying “right sized” (or the solo GPs who are capacity constrained in how many investments they can physically make), as well as the potential re-emergence of the “calm”-type funds. These funds, in my opinion, will be able to gain higher leverage from AI on all aspects of fund operations. More importantly, they will be able to invest in a new class of capital efficient, AI-native companies that might only require a fraction of capital to get to profitability (or scale).

The dark horse in all of this, as I alluded to earlier, are a couple of macro factors. Namely, we seem to be seeing the end of cloud/SaaS optimizations, and potentially a re-acceleration of software revenue growth. Additionally, we will probably see rate cuts in sometime in 2024, which, assuming the economy stays somewhat resilient, will lead to LPs allocating more to risk assets (venture), igniting the start of yet another funding super cycle. Exciting times ahead!

Thank you Will Lee, Yash Tulsani, Homan Yuen, and Andrew Tan for the feedback as I wrote this piece!

Thanks for this. I especially liked the higher frequency and calm funds insight.

As an emerging solo GP I also believe in the calm funds hypothesis.

The higher frequency perspective is actually captured in the explanation of our fund’s operating model. I’ve also started considering whether certain areas of investment have shorter return cycles which would amplify the compounding nature of VC funds over time. I made an investment in a company that has a partial footing in crypto tokens which - if the product/platform being built is successful - has more available liquidity.