By now, it should be obvious to anyone working on or investing in ML/AI that we’re currently in an AI “summer” — with the frothiness of the funding markets seemingly eclipsing that of the Web3 euphoria back in 2021. But underneath this sheen of euphoria, we are already seeing some early cracks in the market, which might serve as leading indicators of depressed future returns, even as funds continue to aggressively compete for and deploy capital into AI startups.

In this post, I explore the current AI investment landscape and present a framework that a typical early-stage fund (funds in the $100-500m scale) might want to adopt. I’ll cover the following:

I first dive into WHY there’s such an intensity in the funding of AI startups, both in the context of the SaaS slowdown in the public markets and Sarah Tavel’s now ubiquitous “AI startups: Sell work, not software” (which has since then been parroted by numerous other VCs)

I then highlight some of the weakness & wonkiness in the generative AI landscape

With the above context, I present a framework for thinking about opportunities in generative AI, highlighting why there’s a shrinking pool of opportunities, even this early in the cycle.

I argue that there is bifurcation both in terms of fund strategies and the size of potential outcomes, and that many funds are underwriting to the incorrect outcomes when making investments. I use AI agents (for the software engineering and paralegal markets) as examples

Given the lack of returns in most sub-categories within AI, I present several paths forward as funds rethink their strategies.

Let’s dive in.

Why are VCs so excited about Gen AI?

While we're indeed in the frothy part of the Gen AI investment cycle, AI is actually transforming various enterprise workflows and processes. Assuming the leading research labs maintain the pace of progress on the model architecture side of things, the very nature of work will be different a decade from now. This time is truly different, and VCs should rightly be excited about investing in AI. But there’s also a mechanical reason why investors, especially traditional SaaS investors, are latching on to Generative AI, and it has to do with the SaaS slowdown after almost two decades of double-digit growth.

Quoting directly from Jamin Ball of Clouded Judgement/Altimeter:

Looking at the basket of ~80 software companies that I track, the median year-to-date (YTD) performance is down 17%. No one has been spared, not even the larger cap software companies. Workday / Salesforce both fell >15% after earnings, with larger drops coming in the days after earnings. Cloudflare and Datadog both fell >10% the day after earnings and have dropped a lot more since then. Mongo dropped >30%. [Source: Clouded Judgement. May 24 2024]

Part of the slowdown is due to macroeconomic headwinds, but we’re also starting to approach the physical growth limits of cloud software (which Scale Venture Partners predicted 5 years ago)! The basic argument that SVP made was that in the early days of cloud computing, cloud-native companies were chipping away at on-prem budgets, and because cloud spend was just a fraction of overall software spend, growth was extremely high (30% according to Scale, vs. 7% for the overall software market).

Given cloud software's initially small market share, it took nearly two decades for cloud companies to reach a significant percentage of the overall software market (see chart below). The issue is that the miracle of compounding has become the curse of compounding, because assuming the growth of cloud software continues at 30%, it would only take another ~4 years for cloud software to saturate the overall software market, which would compress cloud growth down to 7%. Now, there are still many industries still operating with pen-and-paper dynamics or using legacy on-prem software, but the main point here is that “obvious” categories of software are already quite competitive.

What this means for cloud software companies is that the selling motion becomes more cloud company vs. cloud company (compared to cloud software company vs. an on-prem vendor in the past). This increased competition means that for current-day SaaS companies, every bake-off is a knife fight. This has ramifications for VCs as well! It used to be that funds could plow significant amounts of capital into SaaS companies, and when these companies go public, it was directionally correct to assume that the public markets would assign a 10x ARR multiple on scaled out companies (e.g. if a company reaches $100M in ARR, it would be valued roughly at ~$1B). This is no longer true, given multiples are so much lower, which also means smaller outcomes!

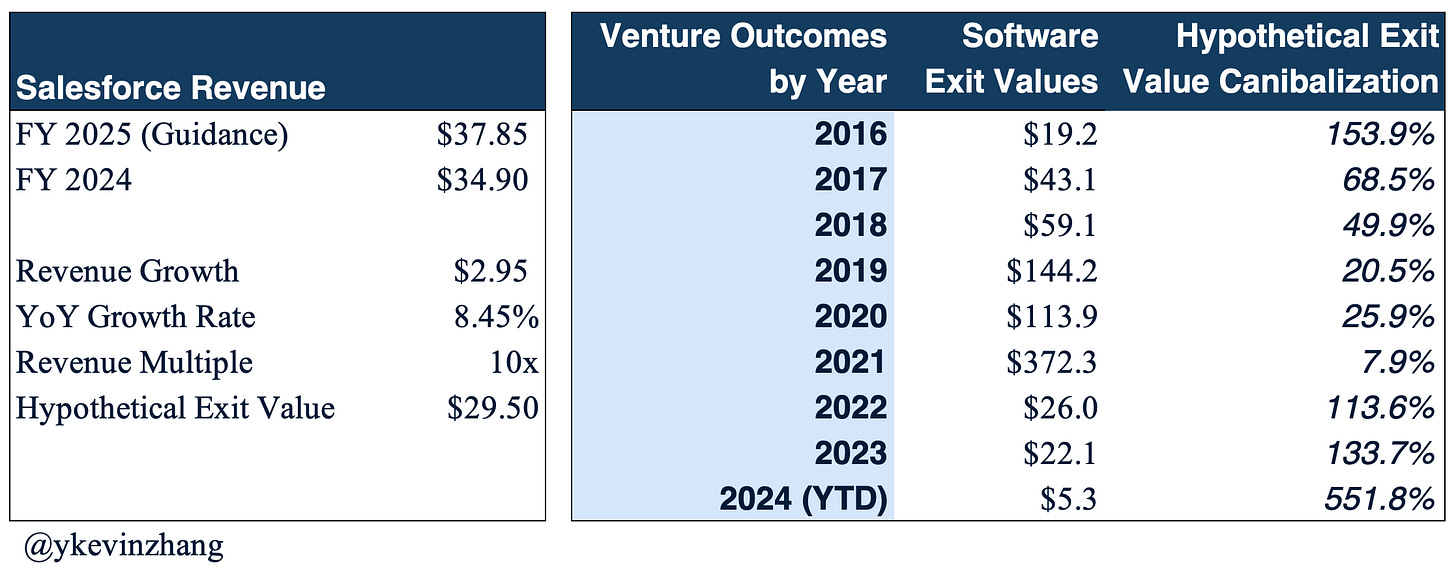

Taking my old company as an example, Salesforce did $34.9B in revenue for FY24, with an FY25 guidance between $37.7B and $38.0B ($37.85B mid-point). This almost created a pandemonium of sorts because it would be the first time Salesforce is guiding to a sub-double-digit growth! But to put things into perspective, that’s nearly $3B in new revenues! In the “old”, low-interest rate regime, that $3B in revenue would turn into $30B in market cap/startup exit values (this is rough estimate as it doesn’t take margins into consideration or adjust for growth, see Meritech’s Rule of 40, or BVP’s Rule of X). In present day, Salesforce’s growth directly “eats” into both the market cap of other public companies and the exit values for venture-backed startups.

Enter Generative AI. Since the launch of ChatGPT in late 2022, the broader world has been exposed to the potential of AI. Then, in August 2023, Benchmark Partner Sarah Tavel penned her now ubiquitous post AI startups: Sell work, not software. The main idea in Sarah’s post was that generative AI software can replace human “work”, and consequently help companies eliminate headcount. One takeaway from this, in our SaaS slowdown context, is that Gen AI companies can sell software that replaces a company’s headcount budget, instead of an enterprise IT budget. Theoretically, this would mean that generative AI companies can grow faster than the growth rate of traditional software companies! The other argument for selling “work” vs. selling seats in a typical SaaS model is that companies can charge more for this work output (e.g. some percentage of the total compensation of a human headcount). This means that these work replacement startups would yield massive outcomes for VCs, because every headcount replacement could mean tens of thousands of dollars in revenue (vs. the low thousands for a Salesforce CRM seat). Given these lucrative returns, VCs have collectively poured tens of billions of dollars into AI companies across all layers. Over the past year, AI investments represented over 20% of all VC fundings.

Weakness in Gen AI investing

Despite the current AI euphoria, exemplified by multi-billion-dollar fundings for companies like OpenAI, Anthropic, and xAI at the foundation model layer, and frothy Seed/Series A valuations at the application/platform layer, cracks are beginning to show in the Gen AI funding markets. To illustrate these challenges, I'll examine three areas: foundation model vendors, compute availability, and Gen AI application revenues.

Starting with the foundation model layer, we’re seeing some early deaths/slowdowns. Inflection’s strange acquisition structure, Adept’s potential sale, and Stability AI's financial woes are only the tip of the iceberg for players at the foundation model layer. As performance gaps between different foundation model startups widen, and assuming incumbents (Google, Meta, Microsoft, Apple) continue executing on their respective strategies, I expect more deaths.

These deaths indicate a maturation of the market and the beginnings of a competitive equilibrium. From a VC perspective, it’s arguable that the nature of VC is that risk capital gets deployed into moonshot ideas, so there should be deaths. The problem here is that VCs are having to deploy roughly an order of magnitude more capital (relative to SaaS companies) to get something competitive to the market (in the $1-10B range, see chart below). This means that VCs are required to write a significant portion of their funds into single investments, even at the early stages. Here, an investment write-off would make it extremely difficult for funds to recover via their other investments.

We’re also seeing some of this weakness via a significant increase in cloud GPU capacity. Even as early as half a year ago, it was almost impossible to get allocations of A100/H100 GPUs. Now, we’re seeing large increases in the availability of on-demand GPU compute, implying a lack of Gen AI app demand. As an aside, we might see a slowdown in Nvidia’s revenue growth once the company fulfills its existing commitments, though all of this changes if there are additional drivers for GPU demand, like architectural improvements that require training of significantly better models.

Finally, at the application layer, we’re seeing that AI application revenues aren’t really catching up to infrastructure investments. Here, I quite like the visualization from Apoorv from Altimeter, where he highlighted that the bulk of AI revenues (and margins) are accruing to the chip designers like Nvidia, with cloud hyperscalers coming in a distant second. Now, it’s obvious that inference capacity needs to be built out before applications can take advantage of generative AI, but we’re seeing a multi-hundred-billion dollar revenue shortfall if we compare infrastructure buildouts to the expected application-level revenue. By triangulating publicly available revenue numbers for companies like OpenAI ($3.4B), Midjourney ($200M in 2023), and more recently HeyGen ($1-35M ARR in one year), we see that there are a handful of companies that are ripping, while the majority of Gen AI startups struggling to find product-market fit. In the longer term, however, I do think applications will end up capturing the bulk of revenues and margins (similar to our cloud applications today), but there’s a lot of short-term pain.

VC investing, via the process of elimination

The contrarian view here is that despite how early we are in terms of generative AI adoption, the actual investment landscape has already become extremely competitive, with a shrinking set of opportunities. So how should investors think about making their investments?

The way I like to approach it is via a process of elimination. Here, I’m primarily viewing things through the lens of an early-stage investor (Seed/Series A funds in the sub-$500M range). Large investment platforms (multi-stage firms with billions in AUM), growth-specific funds, or strategics have the flexibility to pursue different strategies. One note here is that most funds have some version of the chart below, so they are thinking correctly about things at a strategic level, but are making the wrong decisions at the tactical level (e.g. investing in the historically under-monetized ops layer).

The categories in purple (compute substrate, foundation model vendors) are at this point completely out of scope for early-stage funds:

A similar dynamic exists for our blue categories:

Where I do see opportunities is in vertical SaaS. Here, generative AI unlocks automation for “jobs to be done” that in the past required human workers (as Sarah’s blog post argued). Because generative AI is so new, there actually aren’t a ton of scaled-out startups or incumbents, so funds need only to pick from a small basket of early-stage startups.

To illustrate the above point more concretely, we can take convoke.bio as an example (I’m a proud angel investor). The company is building a decision intelligence platform for the pharma industry, and is automating what used to be traditionally pen-and-paper processes (in this case consultant and Excel) in the drug commercialization process. One major technology unlock here is that it’s using LLMs (large language models) as an ETL tool.

Now, the challenge for these vertical domains is that they require the right combination of founders who understand a given domain AND can build highly technical solutions, so the number of contenders in a given space tends to be comparatively small. Smart funds also recognize this, and will pile onto “consensus right” deals, which drives up the entry price. Because vertical companies tend to have smaller exits (e.g. Veeva vs. Salesforce), there’s also an inherent tension between entry price and exit values.

At the application layer, there are also a number of questions that need to be answered:

What happens to “normal” VC companies? There are a couple of interesting trends here. A select few companies are experiencing explosive growth (a la Open AI with its $3.4B run-rate, or Midjourney with its $200M+ run-rate). Solopreneurs, on the other hand, with generative AI tools like ChatGPT, are able to generate meaningful revenues for long-tail use cases. The open question here is what happens to the traditional T2D3 gold standard (the tripling of revenues the first two years, then doubling of revenues the next three)? It’s arguable they aren’t growing fast enough if a company like HeyGen is able to 35x in a single year!

How big is Gen AI TAM, really? For something like customer support, there are already dozens of scaled-out startups/incumbents adding generative AI to their solutions. Even with the potential of replacing human agents, there just aren’t enough dollars to go around for multiple $1B+ outcomes

What is the durability of Gen AI revenues? For something like image generation (Midjourney) or video generation (HeyGen), use cases tend to be more project-based, so the level of churn is higher than a more “traditional” seat-based SaaS.

Underwriting Generative AI Investments

Given this shrinking set of viable investing opportunities, how should VCs evaluate investment opportunities? Here, fund size dictates investment strategy.

My contrarian take here is that at the application layer, returns will be compressed as margins get competed away. This means that in the longer term, generative AI application pricing will end up mirroring current-day SaaS pricing, vs. the much higher head-count replacement pricing. I’ll use two application categories as examples — coding automation via AI agents, where the opportunities are absolutely massive (and likely why multi-stage funds are writing large checks into strong founding teams), and vertical SaaS targeting paralegals in the US, where the ultimate TAM is much more constrained. What’s important is VCs need to know what they are investing in order to price risk appropriately.

Starting with coding agents, we see startups like Cognition raising at a $2B valuation shortly after founding, and Poolside also reportedly seeking a $2B valuation (though Factory AI raised at more modest valuations). Why are top funds deploying so much capital into pre-revenue startups? The answer lies in the ultimate exit value, which I estimate to be over $1T by 2030.

I built a very simplified model with the following assumptions (data accurate as of June 24 2024):

Autonomous/semi-autonomous coding agents replace 80% of global software engineers by 2030. In this highly optimistic scenario, we assume everything goes right (model improvements, agentic architectures, etc.). More realistically, we’ll likely see engineering salaries get compressed, and engineers get more productive via Copilot type tools

There are currently an estimated 26.9M software engineers worldwide

I use the US software engineer growth rate of 25% as a proxy for worldwide growth rate

The average software engineer salary is ~$130K (global salaries will be lower, but I’m using US salaries as an upper bound). I hold salaries constant here (vs. increasing it) as I think salaries will actually decrease as more developers are offshored

I apply a 5x revenue multiple on each scenario to estimate the different exit outcomes (the various hues of blue map the revenues and the exit values)

I then model out three scenarios:

Initially, the breakout winner (either a startup or Microsoft via its Copilot or Google’s Gemini Code Assistant) has pricing power due to technology differentiation, and is able to “charge” 70% of an engineer’s salary

In the medium term, I assume that pricing falls more in line with typical SaaS pricing (monetizing between 10-30% of ROI delivered to customers. I’m using 20% here)

In the longer term, I assume a complete collapse of pricing power as coding agents become commoditized. Here, I model a 90% price drop vs. our medium-term pricing (similar to OpenAI’s various price drops)

As we can see here, if a VC is of the view that coding agents will replace human engineers, then an entry price of $2B is a steal! For a multi-stage investment firm that needs to deploy large amounts of capital, this trade makes a lot of sense.

Now, if we run through the same scenario for the US paralegal market (which was the example that Sarah Tavel used in her blog post), we only get ~$2.5B in exit values, which means that the near-complete automation of the US paralegal market essentially only supports a single unicorn!

Assumptions are as follows (accurate as of June 24 2024):

There are ~350K paralegals and legal assistants in the US in 2023, which we then project out to 2024, which is our base year, using a 4.2% growth rate.

On average, paralegals in the US make ~$66K

The VC identity crisis

It’s clear that the majority of venture firms are facing a bit of an identity crisis. Generative AI represents a paradigm shift, but the available opportunity set for the majority of funds is quite limited. At the compute and foundation model layer, most funds are priced out if they care about ownership. Meanwhile, at the plumbing layer (MLOps/LLMOps, AI as a Service), the bulk of returns will likely accrue to a very small handful of companies. Even at the application layer, we saw that vertical SaaS was the only sub-category that will still allow venture funds to generate some semblance of returns. However, as we saw with our paralegal example, the exit values tend to be smaller than horizontal software platforms.

I see several strategies that funds can adopt to generate returns in this cycle:

Adopt a PE-like mindset for vertical SaaS. This means being extremely valuation sensitive (given the smaller TAMs) and carefully controlling risk/lowering loss rate. Both of these things are easier said than done because investors still have to compete for deals (which naturally drives prices up), and no matter how deep due diligence processes are, it’s impossible to truly eliminate risk at the early stages

Take on more technical risk. This means looking at what’s after AI, or the application of AI in industries with additional technical barriers (e.g. robotics, biotech, etc.). The challenge here is that for these other industries, VCs would be shouldering fundamental scientific risk (in addition to product, execution, and valuation risks). The milestones for funding in these categories are also less clear relative to a “standard” SaaS software company.

Solo GPs / smaller fund sizes: instead of funding companies with massive TAMs, funds might elect to back companies addressing smaller markets that can reach profitability after only one round of financing. The liquidity event for this class of companies might be something like acquisitions via PE.

Regardless of how venture firms choose to “play” this cycle, this almost feels like an existential moment for the venture industry (which I first wrote about in my Tidal Waves in Venture Capital blog post last year). In the Age of Generative AI, the game has changed yet again as investment sizes are even larger, leaving venture firms with even less room for error.

Huge thanks to Will Lee, John Wu, Maged Ahmed, and Andrew Tan for the feedback on this article. If you want to chat about all things AI, I’m around on LinkedIn and Twitter.

Really great piece. Thanks so much sharing your ideas. I had been thinking on similar lines.

I think that impact of a) more capital than ever, b) SAAS timeline c) cost of AI vs VC fundsize d) size of big tech is pretty daunting if you don't take on non-traditional markets like energy etc...

This is a thoughtful piece. It seems to me the magnificent 7 ( msft, goog, AAPL, Amazon, meta, Tesla, nvda) are the new VC’s. the whole gen ai boom is fueled by them . It’s risky , but their folk are sophisticated and cash rich . They are now corpo-states. Corpostates. Probably fewer than 10 in this world .

VCs today can only and should only support a mousetrap that invests outside the greedy eyes of th